How to choose the right investor for your startup?

Wed Apr 10 2024

4 min read

Running a business, particularly a startup, demands capital at every stage of growth. Whether you're launching or expanding, accessing funds is crucial for sustaining operations and driving revenue. The choice of investor can often determine the trajectory of your venture. Ideally, you're seeking an investor who aligns with your vision and values and possesses the resources necessary to foster your startup's growth.

So, how do you choose the right investor for your startup?

- First, do your research. Look for investors with experience in your industry and a track record of successful investments. You can also ask other entrepreneurs and industry professionals for referrals.

- Once you have a list of potential investors, it's important to vet them thoroughly. Look for red flags like a history of litigation or a poor reputation in the industry. You can also check their social media and online presence to understand their values and personality.

But choosing the right investor is just the beginning. Once you have identified a potential investor, you must convince them that your startup is worth investing in.

This is where investment banks can be incredibly helpful.

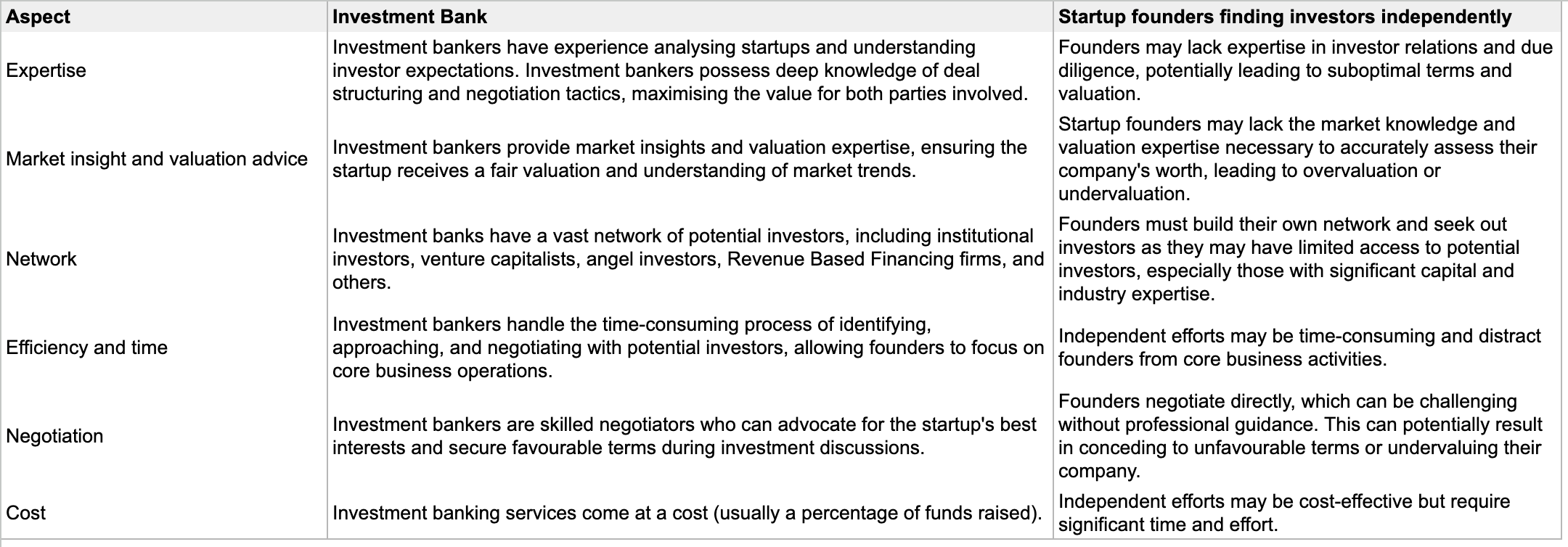

You would ask, why spend on investment banking firms when I can find investors myself? Here's your answer.

Now that you are convinced about the need for an investment banking firm and are ready to onboard one before you sign up with just any firm to grow your startup, you've got to know what to look for in detail.

We sat down with Vandana Tolani, the CEO and founder of Convanto, a boutique investment banking firm. Over the past decade, Vandana and her team at Convanto have successfully helped 220 companies from various industries - including EdTech, FinTech, Consumer B2C & B2B, AgriTech, Healthtech, Foodtech, Disruptive & DeepTech - as well as non-technology sectors from 45 countries raise capital.

What is an investment banking firm, and what services do they offer?

An investment bank is a specialised financial institution that primarily facilitates investments in various projects, particularly startups. These firms are crucial in helping companies access capital markets to raise funds and fulfil other financial requirements.

Investment banks offer a range of services:

- Including facilitating the raising of equity and debt capital,

- Insuring bonds, initiating new capital ventures, and overseeing mergers and acquisitions.

- Additionally, they assist in launching SME IPOs, providing smaller companies with opportunities to go public.

- Furthermore, investment banks provide invaluable advisory services to companies on strategic matters such as corporate restructuring, divestitures, and spin-offs, leveraging their expertise to navigate complex financial landscapes.

- Moreover, they offer underwriting services involving the purchase of securities from clients and subsequent resale to investors, thus facilitating the flow of capital within the financial markets.

How to choose the right investment banking services for your startup?

Choose an investment banking firm that offers comprehensive startup funding services.

When looking for an investment banking firm to help secure funding for your startup, you should consider.

First, consider the size and scope of your startup. Are you a small business with a limited budget or a larger company with more complex financial needs? This will help you narrow your options and choose the right bank.

Second, choose a firm that specialises in advising startups on securing funding. An ideal firm should offer a range of services to make your startup investor-ready, including assistance in creating detailed documents that effectively communicate your business model, growth potential, and financial projections to potential investors, help to craft solid business plans highlighting your unique value proposition and growth strategy and support building robust financial models and determining accurate valuations for negotiating with investors.

Third, consider firms that take a sector-agnostic approach, catering to startups across diverse industries. This ensures they can tailor their services to meet your needs, regardless of your industry focus.

Fourth, look for firms with an extensive network and investor connections. An investment banking firm with an extensive network is invaluable. Look for firms with connections with venture capital firms, angel investors, and industry players. These firms should be able to leverage these connections to introduce your startup to potential investors who are the right fit for your growth stage.

Finally, choose a firm that takes a personalised approach to matchmaking. They should take the time to understand your startup's requirements, growth stage, and long-term vision. By doing so, they can match you with investors who align with your goals, increasing the likelihood of successful partnerships.

However, working with an investment bank also has some potential downsides. For one thing, the fees associated with these services can be pretty high. Additionally, the investment banking process can be complex and time-consuming.

In conclusion, startups have endless tasks to manage, and finding the right investors can be an overwhelming challenge. This is where investment banking firms like Convanto can come to the rescue. With their comprehensive startup funding services, sector-agnostic approach, extensive network, and personalised matchmaking, they guide startups through the complex fundraising process and match them with the right investors. By leveraging the expertise and experience of investment banking firms, startups can focus on what they do best - building their business - while leaving the fundraising to the experts.