Patron Community

How we enabled a win-win scenario for investors & brands

Thu Mar 04 2021

4 min read

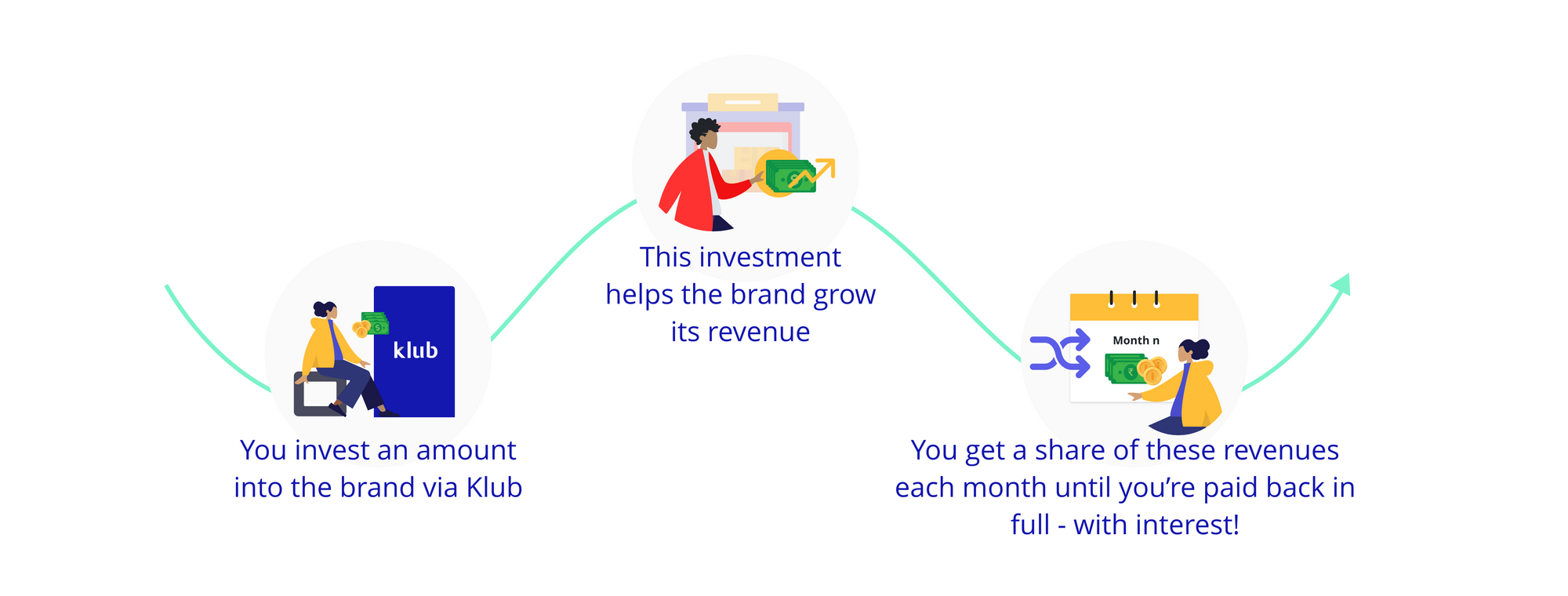

Think of any leading consumer brand you know. Now imagine how great it would be to get a portion of this brand's revenues - Every. Single. Month! We linked brands' revenues to investors' returns. Here's how the model works:

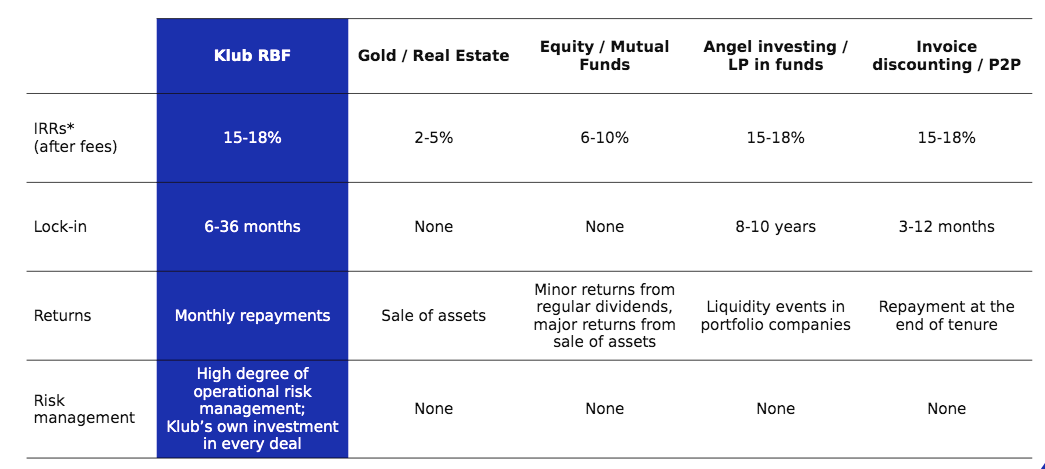

Revenue Based Financing [RBF] is the new asset class that enables this exciting exchange. Instead of asking for equity, like angel investing, RBF asks the brand for a share of its future revenues till the repayments are achieved. Returns with RBF are faster than angel investing, have a lower risk level, and manage to give higher returns than stocks, FD's or Mutual Funds.

RBF as an investment model is championed in India by Klub. It's a way for investors to provide growth capital to loved consumer brands in return for a portion of their future revenues. Here’s why RBF has attracted over a thousand investors already, with more registering everyday:

Attractive returns: While RBF as an asset class is available to investors in the west, it's a unique offering pioneered by Klub in India. Investments through RBF give you attractive monthly returns as a share of the brand’s revenue. Typical investments on Klub’s platform are structured to provide 18-25% IRR to patrons. Higher IRRs are also possible if the brand ends up over performing!

Portfolio diversification: Portfolio diversification: Most investors choose to mitigate risks by spreading out their money in different asset classes . In case of market volatility affecting one asset , it’s possible to make up a loss through another asset . - Klub’s RBF allows investors to diversify their personal portfolio as RBF is uncorrelated with volatility in equity/debt markets.

High liquidity : Unlike other asset classes , like real estate or angel investments in startups, that have longer maturity periods, Klub’s RBF starts giving returns on a monthly basis and has a shorter investment tenure. At Klub, we offer investment tenures between 12–18 months with a monthly repayment of both principal and interest in the bank account of our patrons.

Collateralised investments: Investments through Klub come with the additional downside protection of being collateralized against the assets of the brands. In addition, the investments sit at the top of the liquidation stack of the brands i.e. Klub’s patrons will be paid first before other VCs/founders get paid in case of default. This mitigates some of the risks borne by the investor by providing additional comfort in the case of any defaults by the brand.

Quick turnaround: Unlike other investment opportunities like real estate or angel investments in startups with longer maturity periods, Klub’s RBF collects a daily revenue share from brands, and gives you returns on a monthly basis. At Klub we offer investment tenures between 3–18 months based on the business’ performance, amount, and the use of funds.

Asset-backed investments: Investments through Klub come with the additional downside protection of asset-backing by the brands. This mitigates some of the risks borne by the investor by providing additional comfort in the case of any defaults by the brand.

Support local brands: One of the most loved aspects of Klub is that investors get a chance to be a part of the growth story of some of their favourite local brands. The investment experience comes with a larger community so investors can build long-term relationships with budding entrepreneurs and enjoy rewards from Klub. Klub was founded with this exact vision in mind — to revolutionize investments in growth capital for local brands and to help investors diversify their investment portfolio, get high returns on their money, while promoting loved businesses. We’ve funded businesses across sectors [FMCG, lifestyle, subscriptions, fashion]. If you’re looking to fund a specific sector/brand but don't see any investment opportunities in the space, recommend one to us.

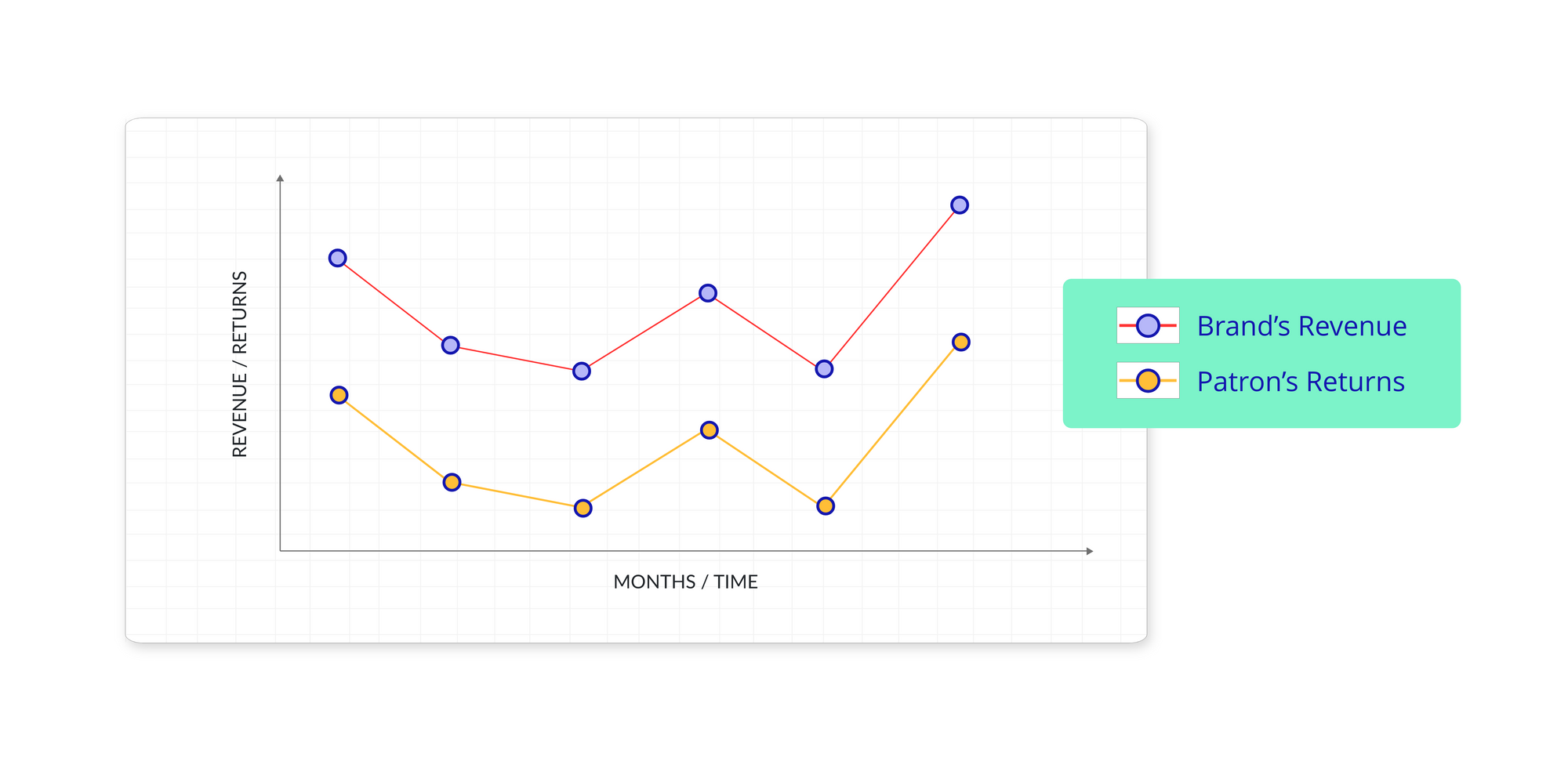

As Invest India puts it, Revenue Based Financing provides an opportunity to earn lucrative returns. Nevertheless, an investor should be aware of the risks associated with the financing model because the repayment rate has a direct relationship with revenues. If the company’s revenues experience a significant decline, the repayment rate will drop proportionally which in turn will have a direct affect on the IRR.

All of the above begs the following question: Is Revenue Based Investing for you? Let's find out.

Some facts you should know:

- Minimum investment amount for RBF: INR 5 lakhs.

- Returns are transferred to you on a monthly basis.

- The typical tenure for investments is 12-18 months and varies for each investment opportunity.

- Klub's process: When you register on Klub's platform to make an RBF investment, Klub's team begins the process of assessing your Investor Profile to protect your interests as an investor. We do this because RBF is a new asset class, and we want to ensure you're fully aware of the risks & potential returns you can earn. Once we've on-boarded you as an investor, all of Klub's deals become available to you.

Some questions you should ask yourself:

- Do you have excess funds parked for investment? Ideally, alternative investments (including Klub RBF) should not be more than 5-10% of your portfolio.

- How experienced an investor are you? If you're investing for the first time, alternative investments (including Klub RBF) may not be suited for you. We would recommend that you invest in low-risk, liquid assets like gold or mutual funds. If you're an experienced investor looking to diversify your portfolio, you've come to the right place.

TL;DR:

- Revenue Based Financing is a new asset class that can earn you above the market returns.

- With RBF, you get monthly returns on your investment, till a pre-agreed yield is achieved.

- It is a mid-to-high risk asset, so it's important to ask yourself the important questions to assess your risk appetite as an investor.

- Investors use RBF for portfolio diversification.

- With Klub's RBF, the terms of investment are detailed out before you make the investment so we can protect your interests.

- Once on-boarded, all of Klub's brand deals become available to you.